I do not understand credit markets

Andrew Bolster

Senior R&D Manager at Black Duck Software, driving data to make AI work

After 20+ years with Ulster Bank (All hail Henry Hippo), and with countless computer, customer service, overdraft, and credit card problems, I’m jumping ship to Santander on the advice of my friends, colleagues and family. It hasn’t gone so well.

Credit Background

I’ve been a good boy, when it comes to finance.

- No loans other than Student

- No Car

- No Mortgage

- No Dependants

- Reasonable ‘Disposable income’ (even if that income is usually ‘disposed’ in either bars and restaurants or gadgets)

- Been employed in one form or another since I was 15

- A few slip ups on the credit card but always paid back within the next month

- A few slips over the overdrafts an undergrad, but who didn’t?

- Currently well out of my overdraft

So I called in last week, asked what paperwork I’d need to move my account, was given great assistance and told ‘We’ve got you an appointment next week and we can sort it all out’

And so it was. Until after a half hour of paperwork with the lovely April (congrats on the baby!), we did the credit report. Usual practice, totally understandable. Not a worry in the world.

Computer Says No

What?

It’s a horribly embarrassing feeling. April doesn’t know if I’m a money laudering drug dealer, or some kind of fraudster, and I’m sitting here thinking about the projects I’m doing with Farset Labs and TOM Ltd and if my newly crippled financial standing is going to affect them.

Of course, due to data protection, April can’t know anything about why I’ve been rejected, so this cloud hangs over us as I awkwardly pack up my oodles of paperwork, feeling like the worst kind of human for wasting this persons time. April is lovely but you can sense an exasperation. I know that feeling well, I did it myself when I worked at Laser and we were doing financing for home electronics, it’s the “You know what you did, and you’re just chancing your arm even trying, all you’ve done is waste my time”.

She tells me that the best thing to do is if I can get a hold of my credit report, and hand it to them (what about Data Protection? Oh who cares, gimme ma bank account!) and let the underwriters make a decision. “You can call them or write a letter, but they’ll charge you for that, go for the website, you get 30-days free trial which should get you the info you need”.

Great, I’ll do that, and I did.

The Report of Doom

I dander up the hill to the office in the rain, trying not to worry about my little entrepreneurial empire collapsing as HMRC come and take me in for fraud, SAS leaping through windows because my cards were used in Brazillian gun running cartels.

Sit down, sign up, log in, “View your report”.

…

What?

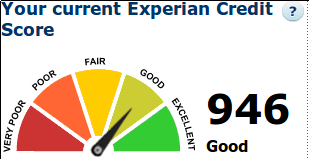

I got rejected from switching a bank account because I have a 90th percentile score?

Ok, So what are the factors affecting this calculation?

There were Two “Positive” Factors and One “Negative” factor. The reason for the quotations will become clear in a second.

Positive Factors

-

“The age of your accounts indicates lenders are likely to view you as lower risk”

- This makes sense since I’ve been with Ulster Bank since I was in primary school, did my first entrepreneurial endevours a long time ago with their business team, and as far as I can tell in a 70+ month history of my credit card, have missed one payment. Not too shabby.

-

“The usage of your available credit indicates a lower risk”

- Again, a bit obvious; the less credit you use, the better you are

- “Having low Credit Limit Utilisation (balance compared to limit) shows that you do not need to use a large proportion of your available credit.Higher utilisation is more likely to be viewed as higher risk by most lenders.”

- No arguments with that, until you get to…

Negative Factors

-

“The value of your highest credit limit indicates a higher risk.”

- “Your current limits on credit and store cards show the amounts that lenders have previously entrusted you with.”

- “Having a low highest limit shows that lenders may view you as higher risk. Most lenders are likely to view you more positively with a high limit.”

- Translation: “We trust you more than your bank appears to, so we don’t trust you”

Hold the phone

So, if I’ve got this straight, I’ve been rejected because:

- I stay within the credit limit

- I haven’t been given a limit that matched my Experian-rated trustworthiness.

Really not sure what to say about that. Sounds like a “not my fault, just my problem” situation.

Resolution

And now I’m on the way down the hill again with my nice and “Data Protected” dead-tree version of my credit history and private information and my past six months of statements, hoping that the Santander underwriters as more sane than Ulster Bank’s

My take away from this isn’t necessarily that its UB’s fault; it’s Experians. The next time this happens to me, I’m going to have to pay Experian £15 for the pleasure of knowing why I’ve been rejected by someone using their credit check scheme. It’s in their direct benefit to screw people with decent credit scores just to get them to sign up for their extortionate self service ‘score’ breakdown.

Depressingly, this could all be sorted if there was some stage in the office, after the credit report came back negative where I could sign a waiver saying “I know of no just reason why I shouldn’t share my credit history with the representative of the bank that I’d like to use”, and let us view my credit score there and then and settle it with someone who actually knows finance in the room.

I’m reasonably saavy when it comes to finance, and it took me a while to work out exactly what this report was saying amid all the numbers and banker-ese, and that was then it already said ‘Good’. I can’t imagine what it’d be like for someone who wasn’t so aware of finance logging in and seeing a ‘Fair’ or even a ‘Poor’ score.

In a similar way that the credit rating companies had a little hand in the whole economy collapse thing, disruption of personal banking by credit agencies giving hidden ratings based on what to me reads like flawed logic (“He doesn’t spend much, must be a fraudster”) can only be bad.

The Current Account Switch Service was designed to enable competitive practice across the banking sector, where historically once you got an account you stuck with it. To quote Chancellor George Osborne:

The new 7 day switching service is central to our reforms to build a banking system that works for customers. This service was a key part of the recommendations of our Independent Commission on Banking two years ago and I’m delighted it has now become a powerful weapon for consumers.

You can’t have a competitive market without having a fluid market, where consumers are free to reasonably move from provider to provider.

Conclusion / TLDR

I’ve been with my bank for over 20 years, and if I wasn’t such a stubborn bastard, I might have been prevented from switching, for the simple reason that I didn’t spend more money than I had.

Will update when I get a true resolution